Why You’ll Love White-Labeling Your Tilled Platform

There’s no need to google “white-labeling” BTW, we’ve got that — and why you should care — totally covered.

We’ll get straight to answering your burning question of “what is white-labeling?” At Tilled, we define white-labeling as the ability for a partner or ISV to customize elements of the Tilled merchant experience with their own company branding. For example, you can apply your brand colors, upload logos, and even create a custom subdomain. And here’s why we think you’ll love it:

1. Payments will feel like a part of YOUR offering

One thing we know about other integrated payments services from our partners is that it can be an awkward, disjointed process. When that handoff from the software company to the merchant happens, it’s like: here’s a random company who will process your payments, so if you’re working with us you’re working with them.

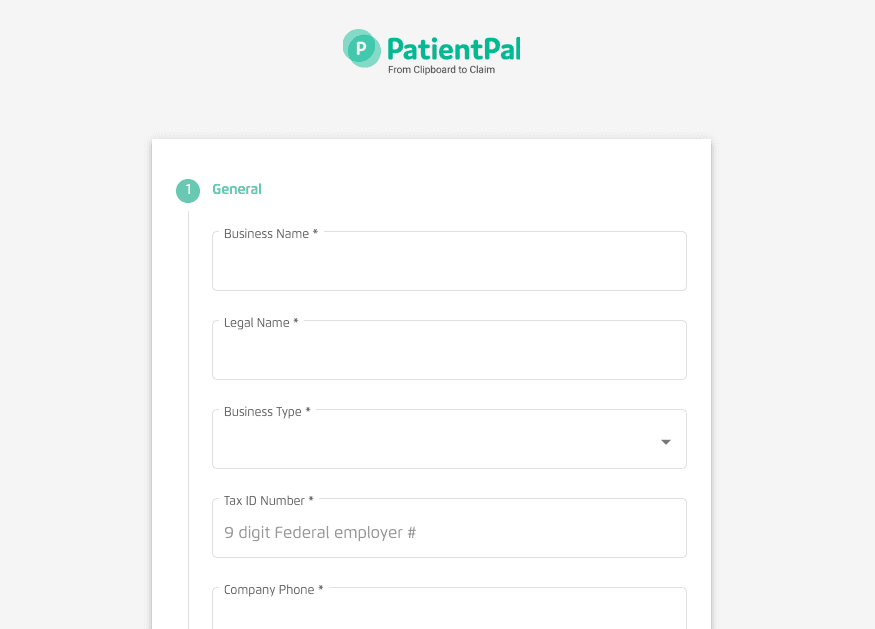

With Tilled, we want our software partners to carry their brand into our payment tools so it doesn’t feel like there’s another company involved in the process. That’s why we built white-labeled Merchant Applications.

With Tilled’s Merchant Applications, software companies and ISVs can easily add their logo into the white-label portion of different features, personalizing their applications. Plus, with our API integration, ISVs can allow account data to automatically flow from their system to the Merchant Application, auto-filling the application with whatever info the software company has on hand. When merchants go to apply for payments, they will have less information to enter (which they’ll SO appreciate!) But more importantly, they’ll feel as if they never left your system — a win-win if you ask us.

2. Your development burden is reduced drastically

There’s no way to sugar coat it; there is a lot to do when it comes to setting up a payment integration. And even once the initial integration is done and merchants begin processing, that’s just where the work begins. ISVs and their merchants also need reporting tools and dashboards to help keep track of all those transactions, and ensure payments are profitable. But with their own software and customers to focus on, the development work it takes to make that possible will ultimately be what makes the software company less profitable. Here’s where Tilled comes in. With our platform, ISVs can access a handful of tools we built to reduce their development burden, such as our Hosted Merchant Console.

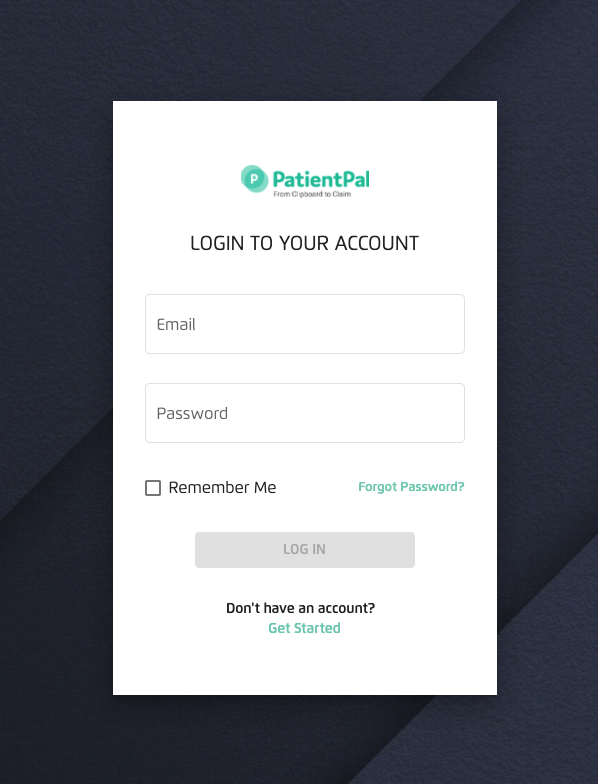

By leveraging Tilled’s Hosted Merchant Console, software companies won’t need to build anything around reporting on payments. Instead, they can direct users to login through a custom subdomain and access a fully white-labeled and branded merchant portal. There, merchants can view their customers and their merchant summaries (a fancy way for us to say “fee reports”), run reports on their payments, and reference their deposits, without ever feeling like they left your system. Booyah.

Here at Tilled, we know how hard you work running your business and managing your merchants. So, let us help you deliver a more streamlined, personalized merchant experience with as little lift on your end as possible. To learn more about our platform’s white-labeling features or our other powerful tools, contact us — we’re here to help!